Categories

Royal Dutch Shell, commonly known as Shell, is a British-Dutch oil and gas company headquartered in The Hague, Netherlands. It is one of the six oil and gas "supermajors" and the largest company in the FTSE 100 Index.

Shell traces its history back to the 1800s when the Royal Dutch Petroleum Company was founded in the Netherlands and the Shell Transport and Trading Company was founded in the UK. The two companies merged in 1907 and became Royal Dutch Shell.

Today, Shell is engaged in all aspects of the oil and gas industry, including exploration, production, refining, distribution and marketing. It operates in over 70 countries and produces around 3.7 million barrels of oil equivalent per day. Shell also has a growing presence in renewable energy and low-carbon technologies like biofuels, wind, solar, hydrogen and electric vehicle charging.

The company is dual-listed on the London Stock Exchange and Euronext Amsterdam. Shell employs around 80,000 people worldwide. Its revenues in 2021 totaled $272 billion with earnings of $20 billion.

Oil and Gas Operations

Royal Dutch Shell is one of the world's largest oil and gas companies. It operates in over 70 countries and produces around 3.7 million barrels of oil equivalent per day.

Shell has upstream operations involved in oil and gas exploration and production in locations such as:

The Gulf of Mexico, focusing on deepwater production.

Nigeria, where Shell has been operating for over 50 years and has extensive onshore and shallow water operations.

The North Sea, with Shell being a major producer in this mature basin.

Malaysia, Brunei and Russia, with significant deepwater and onshore production.

Canada, with oil sands operations and shale gas.

Brazil, a growth area for deepwater.

Shell also has substantial downstream operations in refining, transportation and marketing of oil products and petrochemicals. The company has interests in over 40 refineries worldwide and an extensive retail network with over 40,000 Shell-branded stations globally.

Renewable Energy Efforts

Shell is making significant investments in renewable energy as part of its strategy to provide more low-carbon energy. The company has several major projects focused on wind, solar, hydrogen and biofuels.

Shell operates and has interests in 9 wind power projects in North America and Europe. This includes the 120 MW NoordzeeWind offshore wind farm in the Netherlands, which can power over 100,000 homes. Shell is also developing large scale solar power projects, including a 50% interest in Cleantech Solar, which operates over 500 MW of solar photovoltaic projects across Asia.

In 2021, Shell announced plans to build one of the world's largest renewable hydrogen plants in Rotterdam. The facility will produce up to 20,000 tonnes of renewable hydrogen per year when it opens in 2025. This will help decarbonize Shell's refinery and chemical plant in Rotterdam.

Shell is also investing significantly in the development and production of biofuels. The company has a 50% stake in Raízen, a Brazilian joint venture that is one of the largest bioethanol producers in the world. Raízen produces over 2 billion liters of ethanol annually from sugar cane. Shell also has interests in several other biofuel projects using feedstocks like corn, sugarcane, and soybeans.

Environmental Record

Shell has faced criticism and controversy regarding its environmental record. Some of the key issues include:

Oil spills - Shell has been responsible for major oil spills that have caused environmental damage, including spills in the North Sea and Nigeria. The company has faced lawsuits and fines related to these incidents. Critics argue Shell has not taken enough responsibility for cleaning up spills.

Emissions - Shell has faced criticism for its high carbon emissions. Environmental groups have accused the company of greenwashing by promoting natural gas as a clean fuel while continuing to invest heavily in oil and gas. There are calls for Shell to transition faster to renewable energy.

Arctic drilling - Shell's plans to drill for oil in the Arctic were met with protests and legal challenges. Critics argued the drilling was risky and environmentally irresponsible. Shell ultimately abandoned its Arctic drilling ambitions in 2015 but may still face reputation damage.

Deceptive advertising - In 2021, the Dutch Advertising Code Committee ruled Shell's advertising campaign focused on carbon emissions reductions was misleading and ordered it to be withdrawn. This highlighted concerns about potential greenwashing by Shell.

Lawsuits - Shell has faced lawsuits alleging it knew about climate change risks but continued to mislead the public. A 2021 court ruling in the Netherlands ordered Shell to cut its emissions faster, a landmark victory for environmentalists.

Overall, Shell has faced ongoing criticism from activists, shareholders, and regulators to improve its environmental practices and transparency around climate change risks. Its mixed track record has led to reputational damage and pressure to reform. Reducing emissions, preventing spills, and shifting to renewables will be key challenges going forward.

Financial Performance

Shell is one of the world's largest oil and gas companies by revenue. In 2021, Shell reported annual revenue of $261.5 billion and net income of $20.1 billion.

The company has consistently generated strong profits from its upstream and downstream operations. However, earnings can fluctuate with changes in oil and gas prices. In 2020, Shell reported a net loss of $21.7 billion as oil prices crashed during the COVID-19 pandemic. But profits rebounded in 2021 as energy demand recovered.

Shell's stock trades on the London Stock Exchange and Euronext Amsterdam under the ticker symbol SHEL. Shell's market capitalization is approximately $190 billion, making it one of the largest public energy companies.

Shell's financial strength provides funds for capital investments and allows the company to pay dividends to shareholders. Shell has a long history of dividend payments and aims to increase its dividend per share by around 4% each year.

Leadership and Governance

Shell is led by CEO Ben van Beurden, who took over the role in 2014. He joined Shell in 1983 and has held various technical and commercial roles in the company.

Shell has a two-tier board structure, consisting of a Board of Directors and an Executive Committee. The Board of Directors includes the Chair, the CEO, and independent non-executive directors. It is responsible for overseeing strategy, environmental and social impacts, risk management, and financial performance.

The Executive Committee includes the CEO and heads of Shell's major business segments and functions. This committee is responsible for implementing strategy and managing day-to-day operations.

Some notable members of Shell's leadership include:

Chair Sir Andrew Mackenzie - Former CEO of BHP Billiton, joined Shell's Board in 2019

CFO Jessica Uhl - Has been CFO since 2017, previously held various finance roles at Shell

Integrated Gas and New Energies Director Maarten Wetselaar - Leads Shell's gas and renewable energy businesses

Shell states that its Board and Executive Committee have extensive experience in the energy industry as well as expertise in areas like finance, technology, corporate responsibility, and safety. The company has faced some criticism over executive compensation, but maintains packages are structured to promote long-term decision making.

Major Projects and Investments

Shell is involved in numerous major energy projects around the world, investing billions into developing oil and gas resources as well as renewable energy sources. Some of Shell's key projects include:

The Appomattox Platform in the Gulf of Mexico, which started production in 2019 and is expected to produce 175,000 barrels of oil equivalent per day. The project cost around $1 billion.

The Penguins Redevelopment Project in the North Sea, which extends the life of the Penguins field to 2030s with peak production estimated around 45,000 barrels per day. This project was approved in 2021.

The Whale deepwater well in the Gulf of Mexico, which was announced in 2022 and could produce over 100,000 barrels of oil equivalent per day. It's one of Shell's largest exploration discoveries in the past decade.

The QGC natural gas project in Queensland, Australia which produces over 1 billion cubic feet per day of coal seam gas and provides 8% of east coast gas demand. The total investment has been around $20 billion.

Renewable energy projects like the 120 megawatt Meteoric solar farm in Australia and Hollandse Kust wind farms off the Dutch coast. Shell is increasing investments into wind, solar, biofuels and hydrogen.

LNG Canada, a joint venture to build a large LNG export facility in British Columbia, Canada with an investment of $40 billion. It's expected to ship 26 million tonnes per year when completed.

Shell's major projects and investments span conventional and renewable energy sources across the globe. The company is focused on developing large, profitable energy resources to meet growing demand.

Partnerships and Acquisitions

Shell has made a number of strategic partnerships and acquisitions in recent years to strengthen its portfolio and align with the global energy transition.

In 2021, Shell partnered with infrastructure operator ATCO to launch a new company that will provide low-carbon hydrogen production and transportation in Alberta, Canada. This joint venture aims to produce more than 300,000 tons per year of hydrogen.

Shell also acquired 100% of ubitricity, a leading European provider of on-street charging solutions for electric vehicles. This acquisition supports Shell's strategy to scale up its integrated power business, including renewable power generation, demand response and e-mobility.

In 2019, Shell partnered with Dutch energy company Eneco to purchase Dutch wind farm developer Ecopark, further expanding Shell's renewable energy capabilities. The company also acquired German battery storage provider Sonnen, reflecting its interest in developing smart energy storage solutions.

Earlier deals include the 2016 acquisition of BG Group, which significantly increased Shell's proven oil and gas reserves. The $53 billion deal was Shell's largest acquisition in over a decade and transformed its deep water and liquefied natural gas capabilities.

Shell continues to selectively pursue M&A opportunities and strategic partnerships that align with its plans to reshape and decarbonize its portfolio over time. The company is focused on building scale in low carbon energies while optimizing its oil and gas assets.

Lawsuits and Controversies

Shell has faced its fair share of legal issues and controversies over the years:

In 1995, Shell was at the center of a major scandal when it admitted to disposing of the Brent Spar oil storage platform by sinking it in the North Atlantic rather than dismantling it. This led to widespread protests and boycotts, forcing Shell to backtrack and dismantle the platform on land.

In 2004, Shell overstated its oil reserves, resulting in fines from US and UK regulators totaling $150 million. This also led to the ouster of CEO Philip Watts.

In 2011, Shell agreed to pay $15.5 million to settle lawsuits over an oil spill in the Gulf of Mexico from one of its pipelines.

In 2015, Shell reached a $83.5 million settlement with residents of the Bodo community in Nigeria for two major oil spills that devastated local environments.

In 2021, a Dutch court ordered Shell to cut its global carbon emissions by 45% by 2030 compared to 2019 levels in a landmark climate change ruling. This has major implications for Shell's future operations.

Most recently in 2022, Shell agreed to pay $111 million to settle a lawsuit alleging it was complicit in human rights abuses including killings and torture by the former Nigerian government in the 1990s.

Shell's track record of legal issues highlights the controversies and risks inherent in big oil operations across the world. The company continues to face scrutiny over its environmental and human rights impact.

Future Outlook

Shell faces both challenges and opportunities in the years ahead as the energy landscape continues to evolve.

On the challenges side, Shell must navigate the global transition toward renewable energy while still generating profits from its core oil and gas business. This balancing act requires strategic investments in clean energy projects while maximizing returns from existing fossil fuel operations. Shell also faces pressure from regulators, investors, and the public to reduce emissions and invest more in sustainable energy. Lawsuits related to climate change impacts present further financial and reputational risks.

However, Shell also has major opportunities to establish itself as an energy leader of the future. The company is making large investments in wind, solar, biofuels, hydrogen, and EV charging infrastructure. Shell can leverage its massive scale, engineering expertise, and capital resources to keep expanding its renewable energy portfolio. If Shell can successfully transition to a more diversified energy business model, it could solidify its position as a dominant player in the global energy landscape for decades to come. But the pace and scope of Shell's evolution remains uncertain.

Overall, Shell faces a complex mix of challenges and opportunities ahead. Skillful leadership and strategic planning will be essential as Shell navigates this transitional period in the energy industry in the years ahead. The decisions Shell makes today will shape its competitive positioning and financial performance over the long term.

Shell Oil comparison

|  |  |  |  | |

|---|---|---|---|---|---|

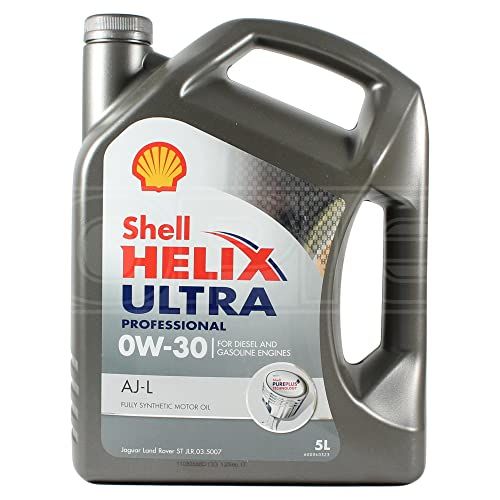

| Model | Shell Helix HX8 ECT 5W-30 - 5L | Shell Helix Hybrid 0W20 - 5L | Shell Helix Ultra 5W-40 - 1 Litre | Shell Rimula R3 Turbo 15W-40 - 5L | Shell Helix Ultra ECT C3 5W-30 - 5 Litres |

| Brand | Shell | Shell | Shell | Shell | Shell |

| Item Model Number | - | 5011987081055 | 5W40 | 550045021 | ACSHEECT5W305L |

| Item Weight | 4.42 kg | 4.6 kg | 910 g | 5 kg | 4.41 kg |

| Manufacturer | Shell | Shell | Shell | Shell | Shell |

| Viscosity | 5W-30 | 0W 20 | 5W-40 | 15W 40 | 5W-30 |

| Flash Point | 300 Degrees Celsius | - | - | - | - |

| Vehicle Service Type | Car | Car | Car | Car, Truck | Car |

| Price | £48.96 | £67.07 | £16.43 | £37.96 | £53.53 |

FAQ

What is Shell Oil?

Shell Oil is one of the largest oil and gas companies in the world. It is a subsidiary of Royal Dutch Shell and operates in over 70 countries. Shell is engaged in every aspect of the oil and gas industry including exploration, production, refining, distribution and marketing.

When was Shell Oil founded?

Shell Oil was founded in 1912 when the Royal Dutch Petroleum Company and the Shell Transport and Trading Company merged their operations in the United States. The Shell Oil Company was created as a holding company for the U.S. assets of the newly merged company.

Where is Shell Oil headquartered?

Shell Oil's headquarters is in Houston, Texas. The company moved its headquarters from New York to Houston in 1971.

What products does Shell Oil sell?

Shell sells oil, natural gas, petrochemicals, gasoline, diesel, aviation fuel, lubricants, liquefied natural gas and renewable energy solutions. Shell has over 44,000 service stations worldwide.

How many employees does Shell Oil have?

Shell Oil employs approximately 83,000 people worldwide. It has major operations in over 70 countries across the globe.

What are Shell's most profitable operations?

Shell's most profitable operations are in the liquefied natural gas sector and deepwater oil production. Major deepwater projects are located in Brazil, Gulf of Mexico and Nigeria.

Is Shell Oil exploring renewable energy sources?

Yes. Shell is making large investments into wind, biofuels, hydrogen and solar energy. The company aims to cut its carbon emissions in half by 2050.

What is Shell's market value?

As of 2020, Shell's market capitalization is £126 billion. It is one of the largest publicly traded oil companies in the world.

Who is the current CEO of Shell?

The current CEO of Royal Dutch Shell is Ben van Beurden. He became CEO in 2014.

What is Shell's logo and what does it represent?

Shell's logo is a scallop shell. It is one of the most recognizable logos in the world. The original 1900 logo was meant to represent the origins of Shell's business in seashells which were harvested to make decorative items.